Using design and analytics to uncover fraud and monitor compliance

Services

D&A Solutions

When we needed creative and effective ways to help automate compliance, Axis Group came through with innovative designs that will make a real difference.

Chief Operating Officer, Global compliance and investigations firm

Meeting the Challenge

How can compliance investigators sift through millions of transactions more quickly, to better focus on potentially fraudulent activities?

Compliance personnel and investigators often wade through millions of records looking for needles in a giant haystack. Since it's impractical to review every journal entry, vendor application and travel expense, companies tend to create reports that rely on simple rules, such as expenses that exceed a certain amount. Unfortunately, this approach can flag too many false positives to review effectively. It also misses the opportunity to examine transactions in context, or drill into other related data that could expose a broader pattern of fraud that depend on a web of interdependent companies, schemes and bad actors.

Our client's compliance team was overwhelmed with false positives while looking for shell companies, over-billing schemes and ghost employees. They knew there had to be a better way.

That's when they called Axis Group.

Our Solution

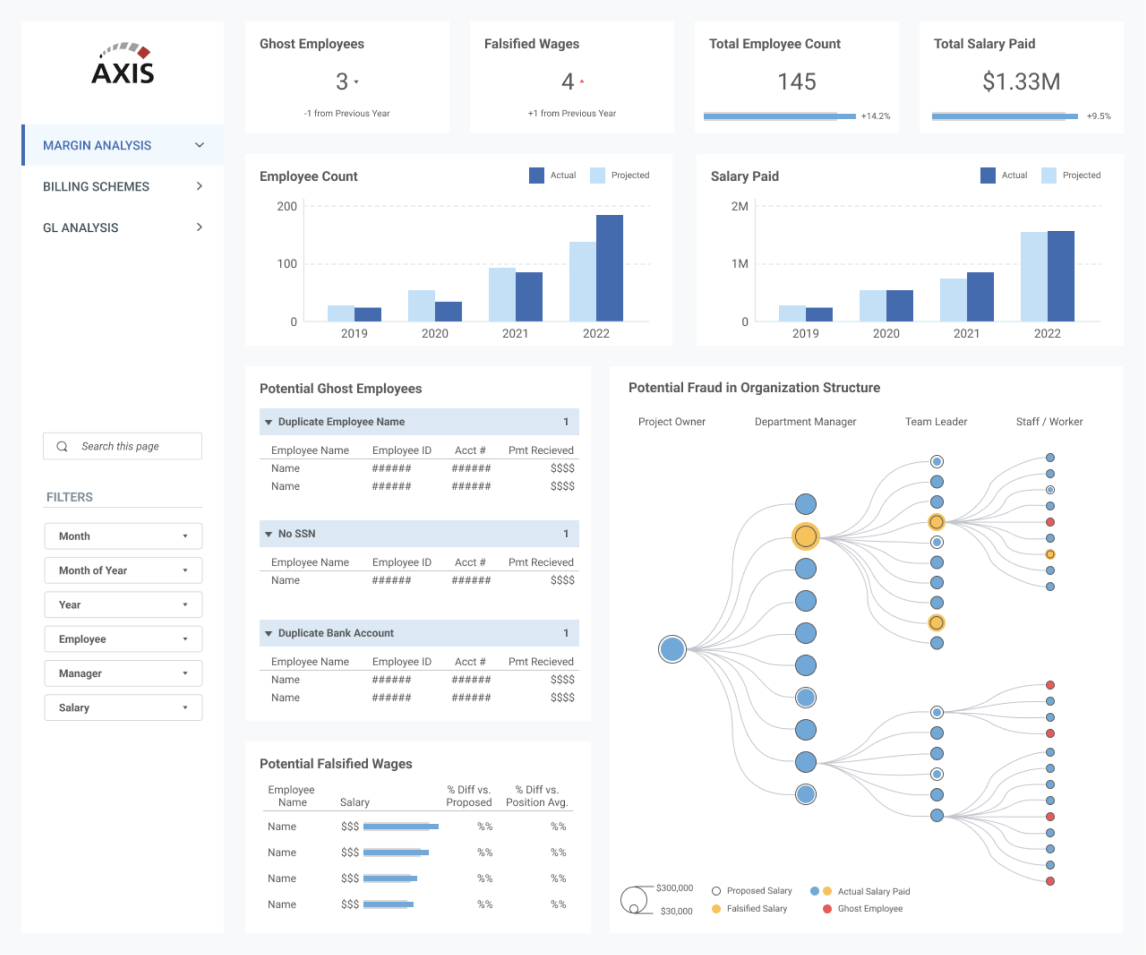

Axis designers developed innovative visualizations that make it easier to spot possible fraud.

Our client needed better ways to identify and reduce fraud, uncover new fraud schemes and automate the investigation processes to increase throughput as much as possible—which would also improve margins.

We began by researching the myriad ways that employment/operational frauds could occur in this arena and documenting the forensic traces they leave in the data trail. Once we learned the essence of the problem, our team applied design thinking principles, brainstorming new ways to visualize those data trails that naturally aligned with our client's investigative process.

By using principles of visual analytics, Axis helped our client cut through the noise, spot outliers and prioritize those actors and transactions that are most worth investigating. By the end of the project, Axis had designed innovative visualizations to help automate and detect potential fraud in payroll, billing, and general ledger activity.

Solution Sample: The Payroll Scheme analysis puts payments into context of the various actors involved. By presenting the data in a visual hierarchy, the analysis sheds light on potentially fraudulent employee activity that may require confederates, such as ghost employees, falsified or padded hours, or pay rate alteration.

Are you ready to take the next step on your Data & Analytics journey?