USIC: Identifying high-risk fleet drivers and reducing safety claims

Services

D&A Solutions

D&A Strategy

Axis Group’s approach to improve driving behavior was a full 2 years ahead of its time. The cutting-edge algorithm we produced is literally a life saver, because USIC operations management can now predict high-risk drivers well before an accident might occur.

If you are thinking about using big data in a predictive, targeted, actionable manner in your business, then Axis Group should be your first and only call.

Tom Karnowski, Vice President, Environment Health and Safety @ USIC

Meeting the Challenge

How can a company use data to predict—and correct—poor driver behavior?

USIC - the “call before you dig” people - sends technicians to the field to prevent damage to underground utilities. With thousands of technicians driving to conduct more than 70 million “locates” annually, it is inevitable that some drivers operate less safely than they should.

Since USIC’s drivers travel more than 200 million miles annually, USIC struggled to identify which drivers posed the greatest risk, and how to use that data to improve safety and reduce accident claims against the company. USIC spent hours wading through spreadsheets and doing ad hoc analysis, a slow process with spotty results.

When USIC wanted a better way, they called Axis Group.

Our Solution

Axis developed a driver safety scoring algorithm using USIC’s rich telematics data

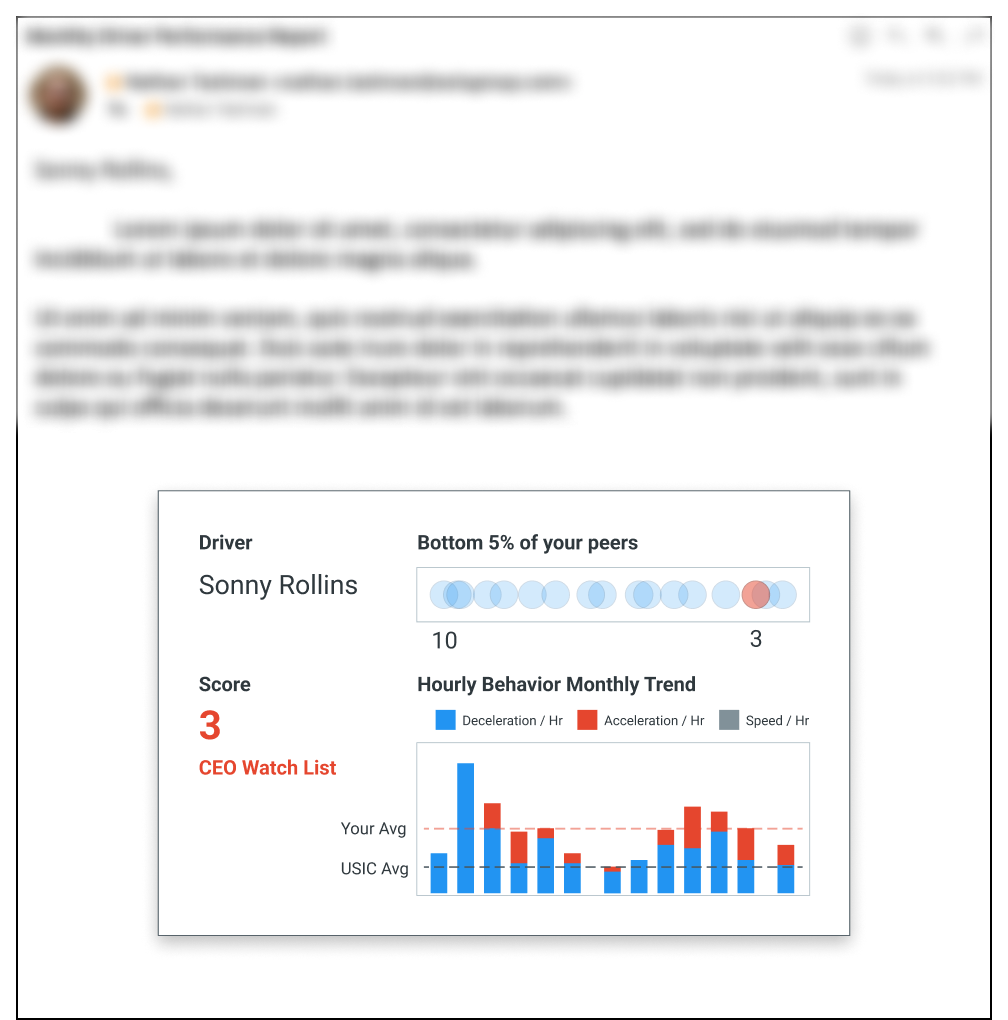

By combining several data points that are automatically collected for every trip, USIC now creates a weighted safety score for every driver. Points are assigned for safety alerts, speeding, deceleration and acceleration events, and past accidents.

The new algorithm had immediate results on awareness, safety, and claims. Studies have shown that 95% of US drivers believe they are excellent behind the wheel. Once USIC started sending personalized safety reports to drivers every week, safety scores improved significantly. Drivers who thought they were driving safely became more aware once they saw their driver scorecard for the week.

Solution Sample: Using a Personal Driving Report approach helped reduce claims frequency by 5% and severity by 28%, even as the number of drivers and miles increased.

Are you ready to take the next step on your Data & Analytics journey?