Bridging the gap between financial reporting and transactional detail

Manufacturing

D&A Solutions

Uncovering the real factors that impact profitability in near-real-time lets us address them quickly and make better supplier decisions.

Director, Finance Operations

Meeting the Challenge

How can the Finance team uncover the real factors driving changes in profitability?

With the boom of eCommerce and COVID-19 in early 2020, our customer—a global manufacturer of finished goods for the automotive industry—saw an unprecedented shift in product demand across their lines of business. While traditional automotive B2B were unexpectedly declining, consumer B2C electronics were suddenly booming. Unfortunately, limitations in the company's disparate legacy systems presented real challenges to effectively analyze and plan around these changes, and finance leaders struggled to analyze where shifts were happening and decide where to invest for growth.

But the data most readily available was highly aggregated and did not provide the level of detail needed to truly understand the underlying causes of any fluctuations in sales or costs. Connecting aggregated P&L activity with underlying transactions across the company was a manual process—time-consuming and prone to errors—to integrate transactions with aggregate P&L data from different systems and conduct analysis.

The rapid shifts in demand caused by the pandemic finally forced our customer to look for a better, faster way to analyze P&L data and make more informed business decisions.

Our Solution

Axis designed a solution that integrates balance sheet, P&L and transactional data

To address the company's challenges, the Axis team developed data pipelines and an application that bridged SAP BPC with their general ledger accounts system, using SAP, Snowflake, Qlik Sense and Matillion. This allowed finance leaders to quickly and easily drill down into the details behind fluctuations in sales or costs.

Now, the company can identify the specific functional areas and general ledger accounts that drive the changes to find out what's really causing a spike, such as increased air freight charges during lockdowns.

Axis’s solution enabled our client to better understand and analyze their data, assess their financial health and make more informed decisions.

Finance leadership can see and respond to new drivers of fluctuations in sales or costs, and finally drill into the GL account details without switching systems and losing context. With that information, they can make instant decisions.

FP&A could now assess key risks and opportunities, better optimize their budgeting and forecasting process, and improve forecasting accuracy.

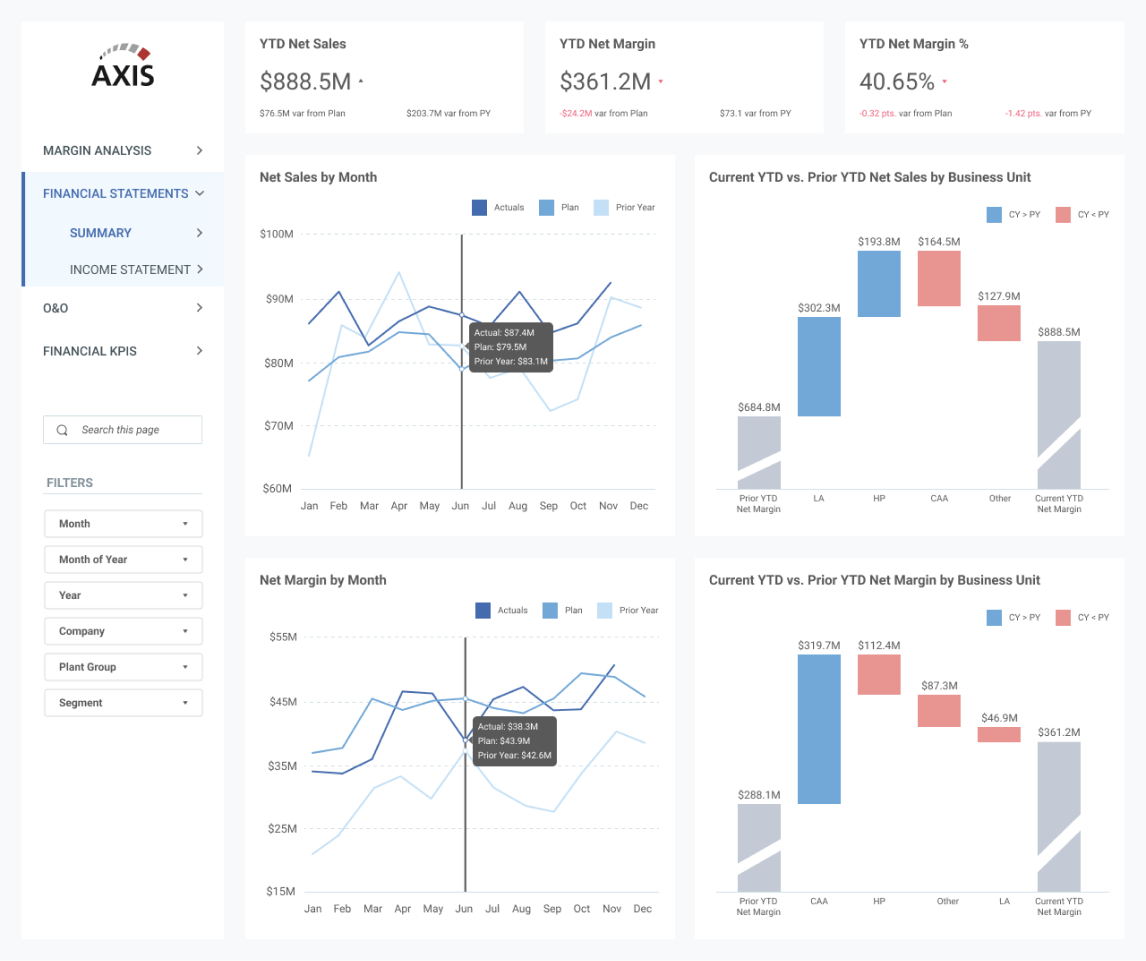

Solution Sample: By combining aggregate P&L data with low-level transactions, Finance leaders can more quickly analyze changes to profitability and identify the drivers that need attention.

Are you ready to take the next step on your Data & Analytics journey?